As a property development and investment company, our experience has helped us perfect how to maximise returns by spotting the marginal gains which other property developers in London often miss.

Successfully transform property development opportunities into higher yields and margins on cost faster than many others in the industry. Our proven techniques allow us to achieve the maximum possible risk-adjusted return on all of our London property development projects.

-

Identify

properties with real potential -

Purchase

in Joint Ventures with equity investors -

Maximise

Value

through refurbishment and development -

Maximise

Efficiency

by pre-selling/letting properties and collecting payments in advance -

Realise a significant

Capital gain

and return capital to investors

Our process starts with the ability to discover opportunity. With our experienced team and intricate knowledge, our network enables us to filter through more than 1000 properties every month before selecting up to 25 potential London developments for detailed due diligence.

Our financial models are highly detailed which highlight our expected level of return and the potential risk involved – a cap we strictly adhere to.

Once an investor has agreed upon a project, we are able to move incredibly quickly which is what provides us with such a competitive edge over most property developers in London and why we are one of the UK’s fastest growing property development and investment companies.

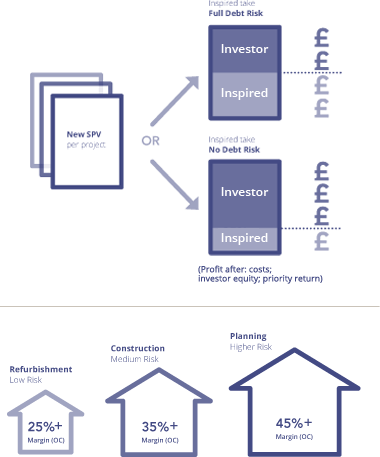

Inspired purchase properties via dedicated SPV’s (Special Purpose Vehicles). The structure reflects the agreed profit share, with investor funds covering immediate upfront expenses such as the initial loan and building works.

As with most luxury London property developers, we tend to refinance our developments at preferential rates through traditional finance once the first few units are built or once detailed planning has been passed and substantial value has been added.

Investors are involved on a fixed return basis, which is normally between 10% – 25% p.a). We also joint venture with 3rd party property developers in London, allowing us to take on larger projects in addition to purchasing outright or provide funding for smaller projects.

We have a respected track record of our ability to strip properties back at a high speed and re-build them in a uniquely efficient format. Space is created, home technologies are installed and the price per square foot inevitably increases to boost the resale value of the unit and interim rental yields.

We focus on properties with an existing residential element or that benefit from Permitted Development (PD) rights, simplifying planning permissions whilst applications are made to add more residential units.

We believe we are leaders amongst London property developers in turning projects around fast and to the very highest standards (small projects within a matter of months and large scale projects within 3 years owing to the intricacies of local planning requirements).

We always structure our investments to be as tax efficient as possible, utilising tax breaks such as entrepreneurs’ relief.

Before we sell a completed development we rent it to optimise its profitability, using a unique model to achieve greater rental returns with a lower risk of vacancy, default or damage that many property developers in London experience.